Construction worker drawing by Marlon Violette.

Case Study—

Identifying reasons for an increase in customer cancellations.

At the peak of the pandemic in 2020, our call centers at Homesite Insurance saw an increase of 48% for cancellation-related calls for the renters' line of business within our insurance policy platform. Not only were we losing customers, but a call to speak to a rep cost the company an average of $18 per phone call.

Why was this happening?

Customers were making life changes because of Covid-19. People out of work, downsizing, upsizing, being closer to family, taking care of mom, improved livability, homeownership, or finally ‘checking off their list’ of to-dos. Research study results showed that a percentage of customers were canceling not because they were dissatisfied with service but instead were unaware of their options to transfer or move their insurance policy.

(Roles)

UX Design

UI Design

(Methods)

Customer Survey

Design Thinking

Affinity Diagrams

Mobile First

(Tools)

HotJar

Figma

Miro Board

How the problem was approached

The business team commissioned a quantitative research study to uncover why this was happening and to inform possible strategic interventions to slow the cancellation volume.

The goals were to discover why the call centers were handling a sudden increase in customer cancellations, devise a game plan of how to mitigate cancellations and strategize for the next steps

Querying our customers

We developed a survey for a customer pool of existing and new homeowners to understand the functional and emotional drivers to purchase homeowners' insurance, identify experience improvements, and Illuminate new and existing homeowner segmentation.

Method: Online survey, 24 survey questions, with 300 participants

Results of our findings

Customers were making life changes suddenly. Some were canceling not because they were dissatisfied with service or pricing but instead moving out to other places for jobs, career, family, and the ‘Next Chapter.’

Additionally, some customers were unaware of their options to transfer or move their policy.

We decided to provide two solutions to make ‘transferring a policy’ easier and to mitigate customers leaving to our competitors.

1A) Solution for Moving Customers

Create a new visible CTA

Improve quote referrals

Create a new mover’s narrative

Remove further confusion by integrating the disconnected processes

Make form entry easier with pre-populated fields

Provide customer grooming and education

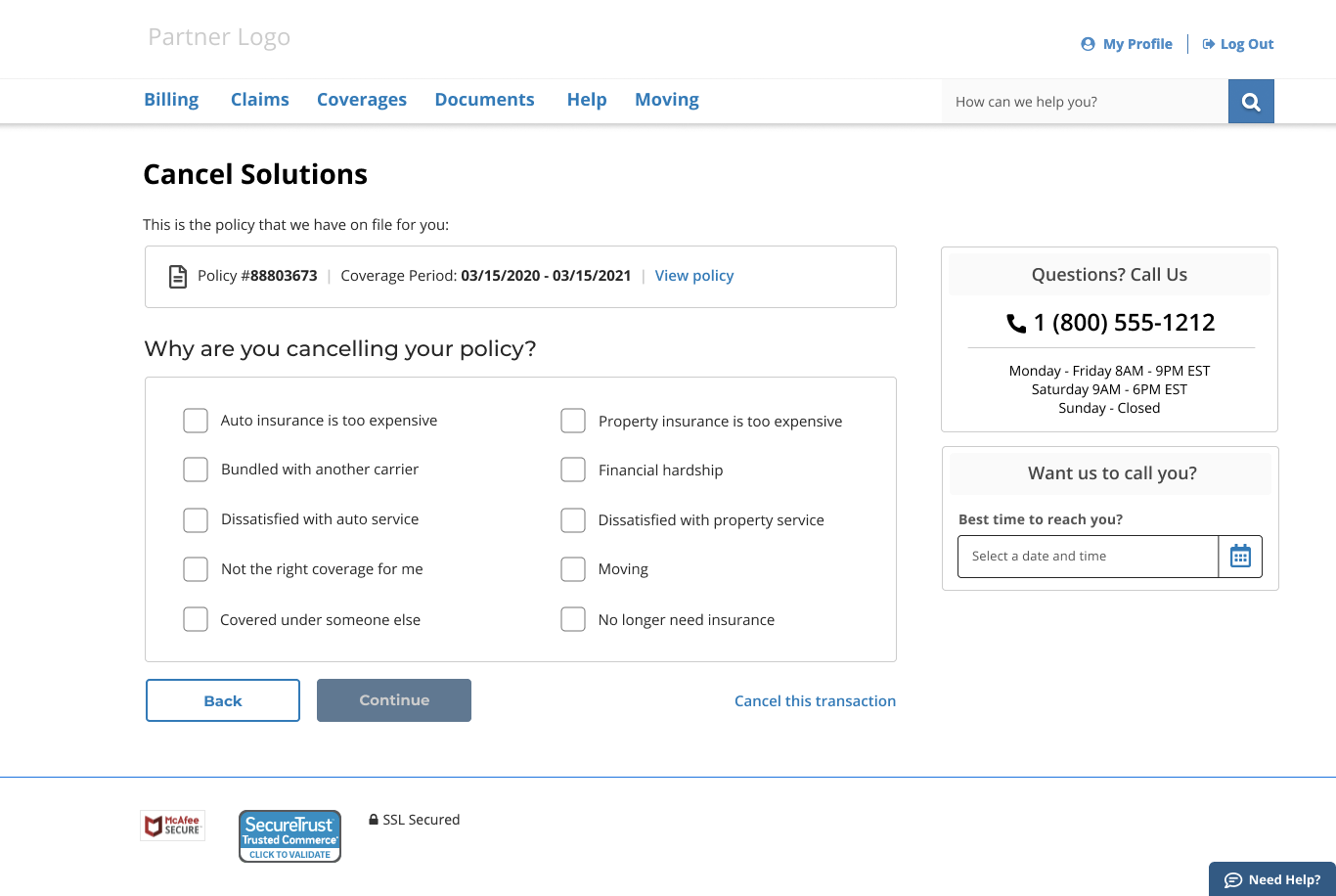

1B) Solution for Cancelling Customers

Allow customers to cancel and collect data without being intrusive

Attempt to pivot customers by giving high-level choices: Need help with something? Are you looking for a better price? Ok, let’s help you cancel your policy.

Develop experience flows dictated by cancellation reasons

Create new entry points for cancellation

Promote product value (attempt to pivot customer)

Did we reach our goals?

Yes, we did.

We were very successful in our efforts to usher renters into homeownership and mitigate cancellation at our targeted percentage. Specific data points to 6% which is about 160K customers.

Improved renter to homeowner's experience in the servicing side by retaining 7,560 customers and $4.3M in sold premium

Established a 'graduators' narrative supporting a renter's moving experience into a new homeowner's experience

Capitalized on the timing of delivery to intake pandemic upsurges of Next Phase customers.

Since the release, 6% of our customers have been retained, equaling 1.6M in premium.

360K calls are not going to cancel; instead, they are re-quoting for better offers.

10% of customers are opting in to future chase emails, meaning they have agreed to allow us to email them at a later point.