HOMESITE INSURANCE

Case Study—

Cancelling Your Insurance

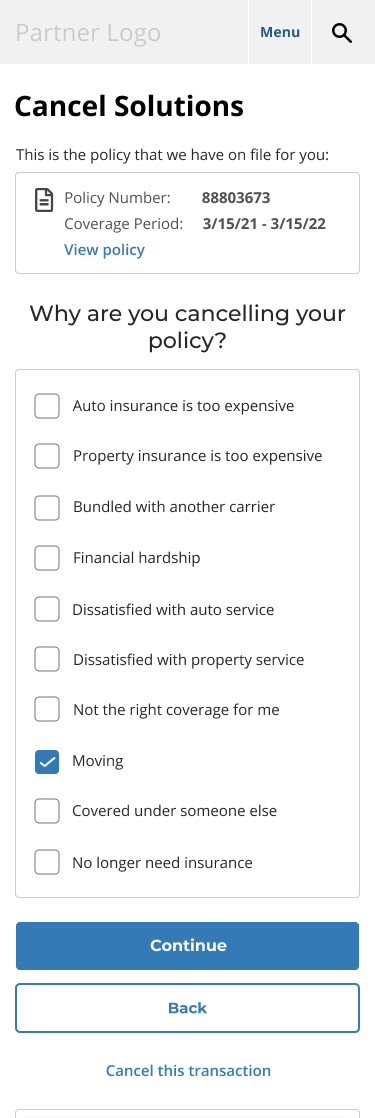

Pedro wants to cancel his current insurance policy because he is moving. Unfortunately, his insurance website is not making this easy. If only there was a straightforward way to cancel his insurance policy.

The process of canceling a policy can be confusing because there are different intents on why a customer would cancel.

Do you need to cancel because you're moving?

Or, do you need to cancel because you purchased another policy from another carrier and don't need two policies?

Canceling a policy is also a unique case for students and migrant workers. Sometimes students just need coverage for their apartment for the academic year. Seasonal migrant workers need coverage for the months dictated by their trade. Both of these groups will need to cancel not because of dissatisfaction but because of requiring only limited dates covered. From a business point of view, this presents an opportunity for a follow-up to regain their business.

Finally, some customers may bundle auto with home with a different carrier and receive a discount. This is insightful and again another opportunity for us to close our gaps in finding ways to retain the customer.

(Roles)

UX Design

UI Design

(Methods & Tools)

Design Thinking

Affinity Diagrams

Mobile First

Tableau

Figma

Illustrator

Miro Board

The Problem

Customer retention has been declining in the pandemic. We're unsure if this relates to Covid-19, people out of work, up or down-sizing, or folks experiencing new changes.

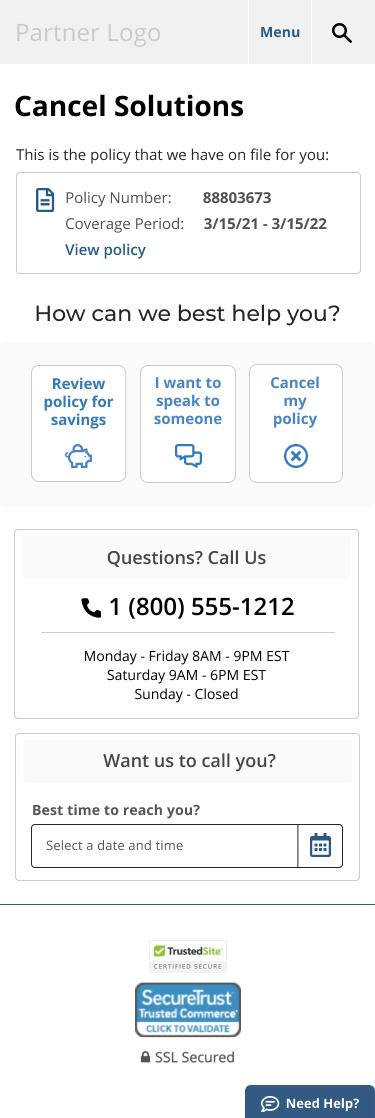

In our servicing platform, the ability to cancel or move a policy is difficult to find. To cancel a policy, one must enter specific keywords in the search feature. Even then, what returns back in the search results is not helpful for the customer. When a customer does call in to cancel or move their policy, it ends up being a costly affair.

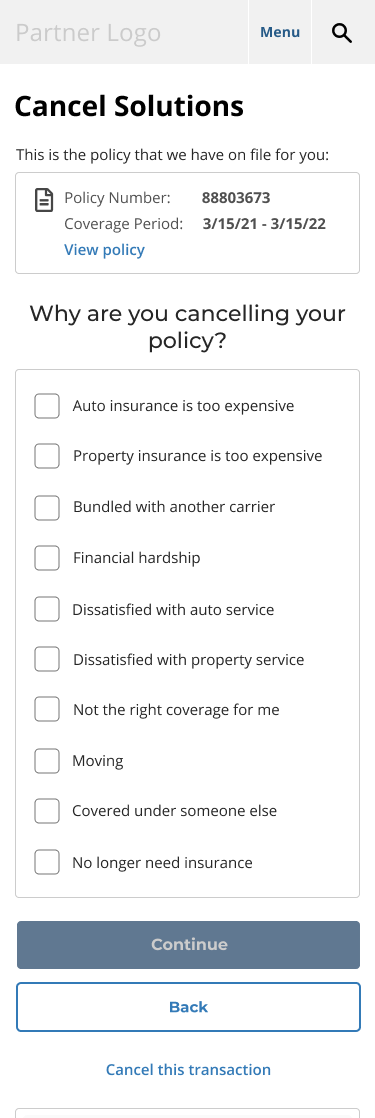

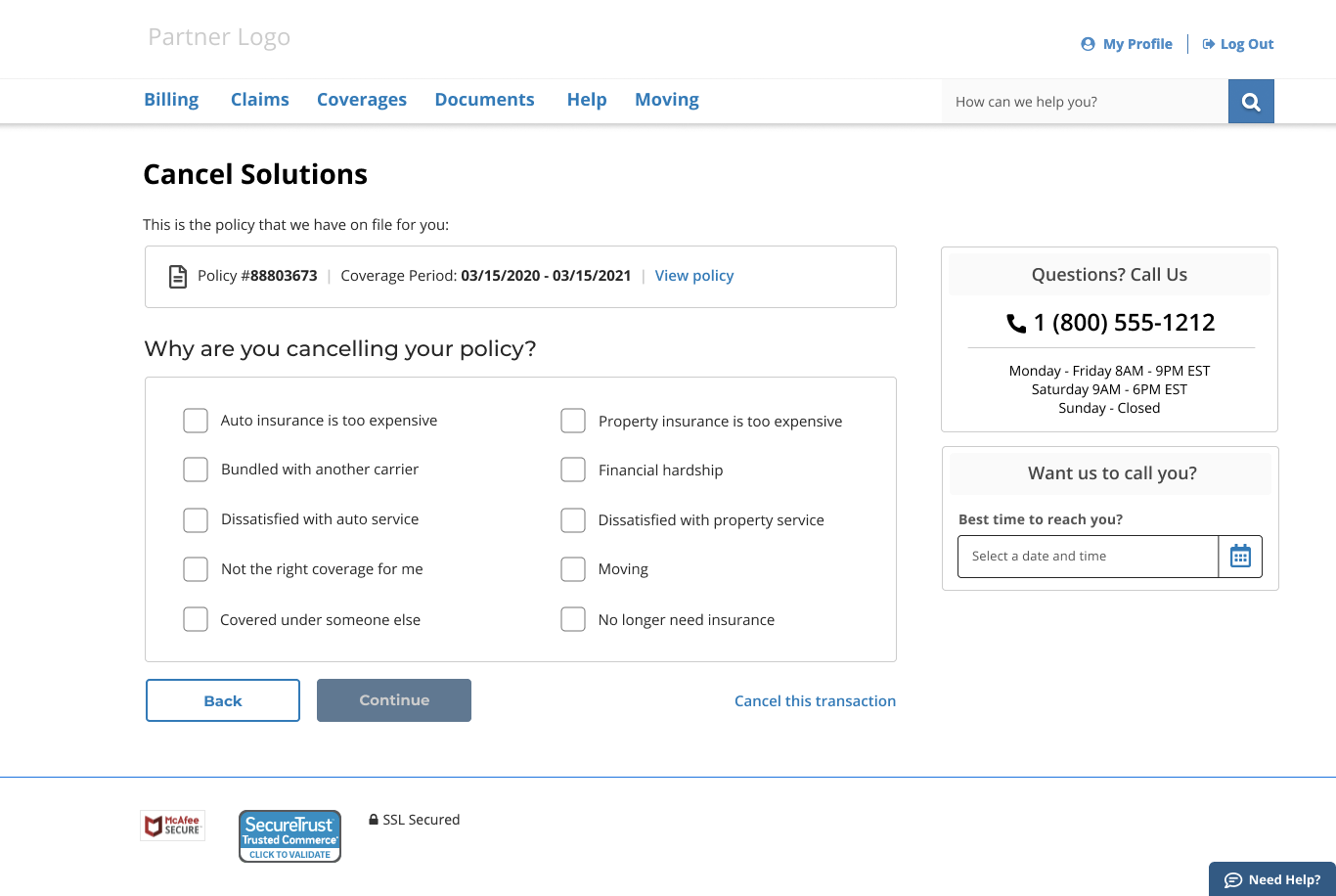

Lastly, we have no supporting data available for reasons of leaving.

The Solution

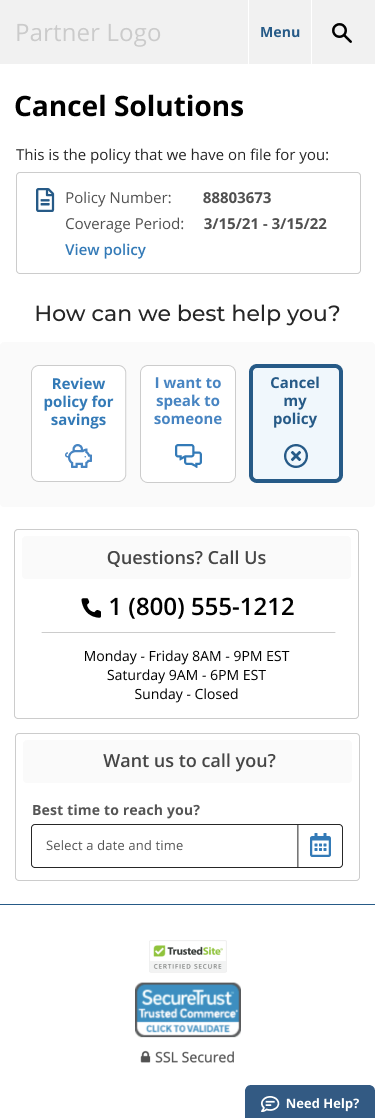

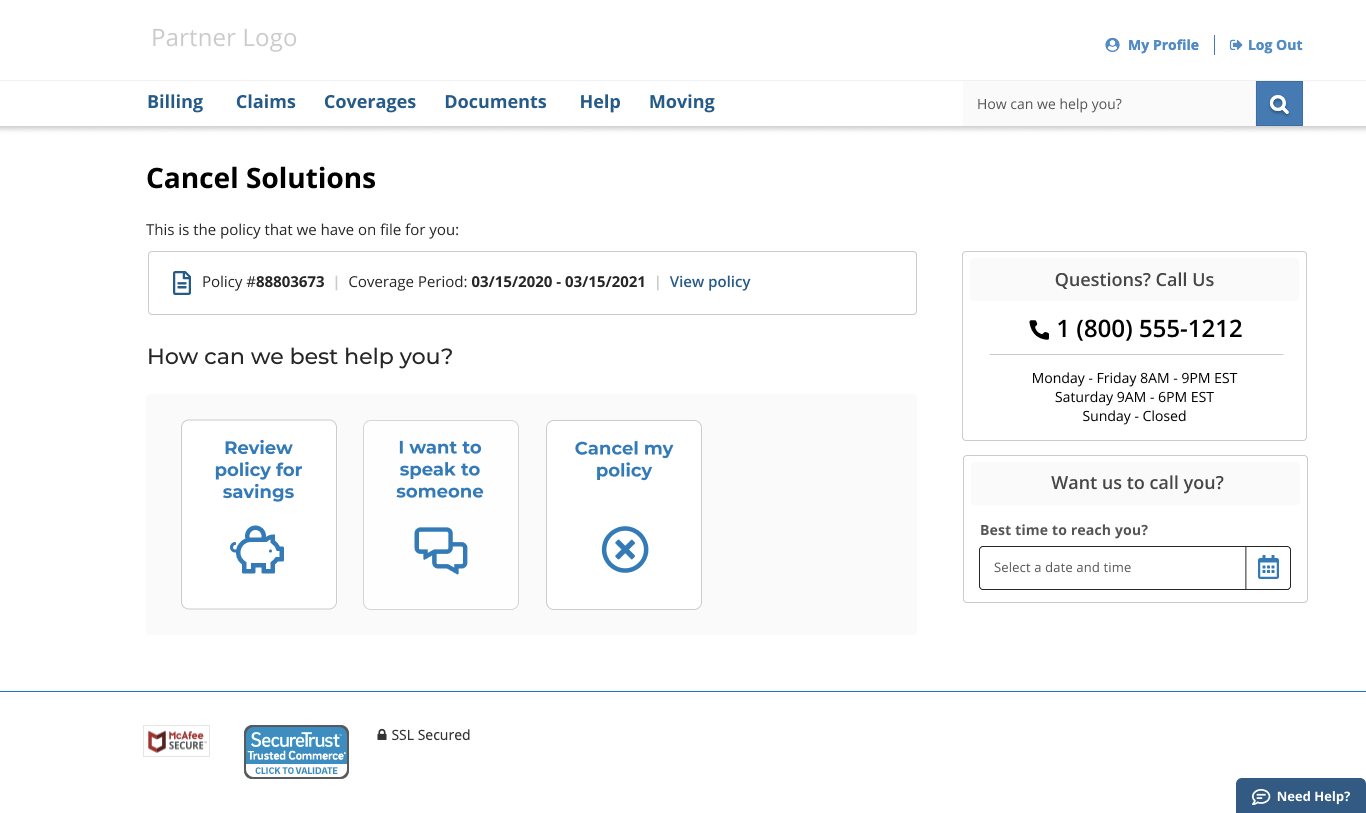

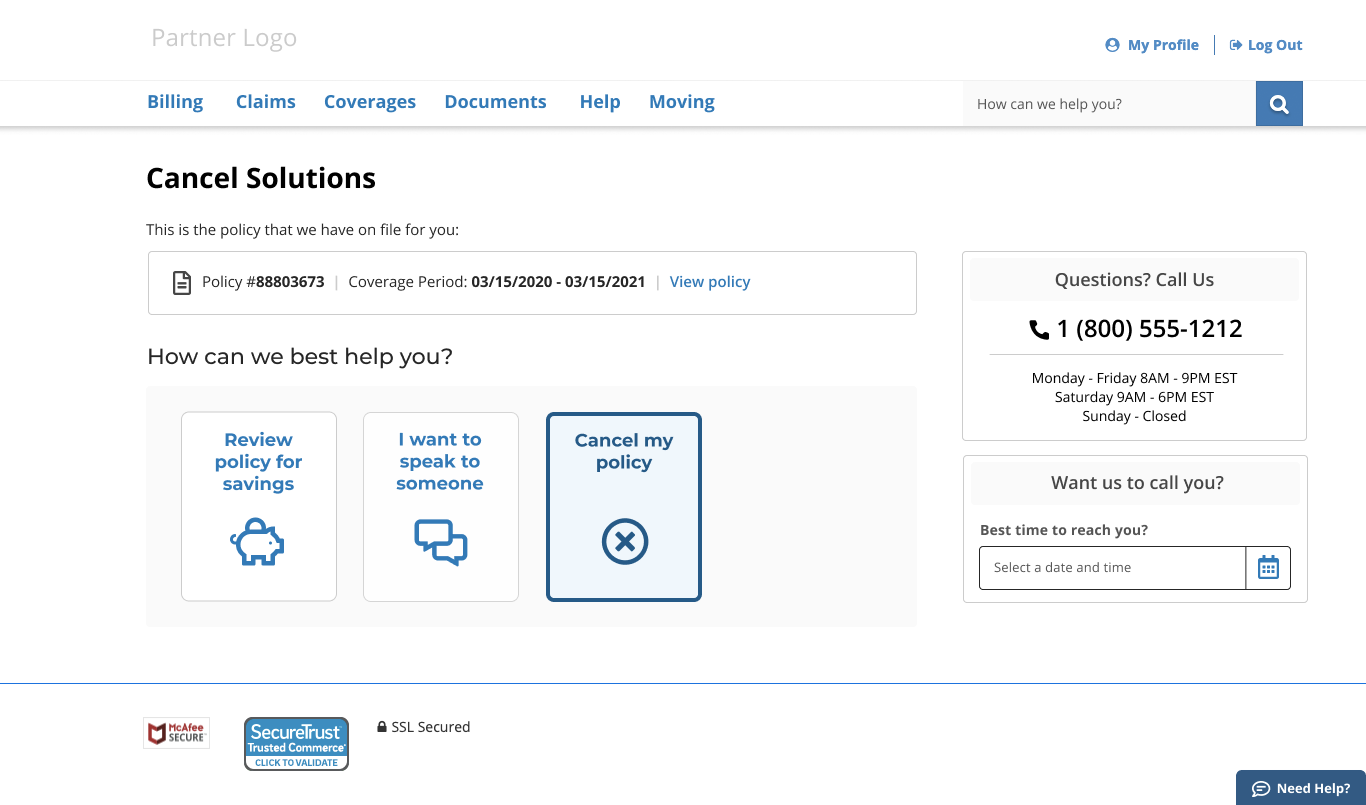

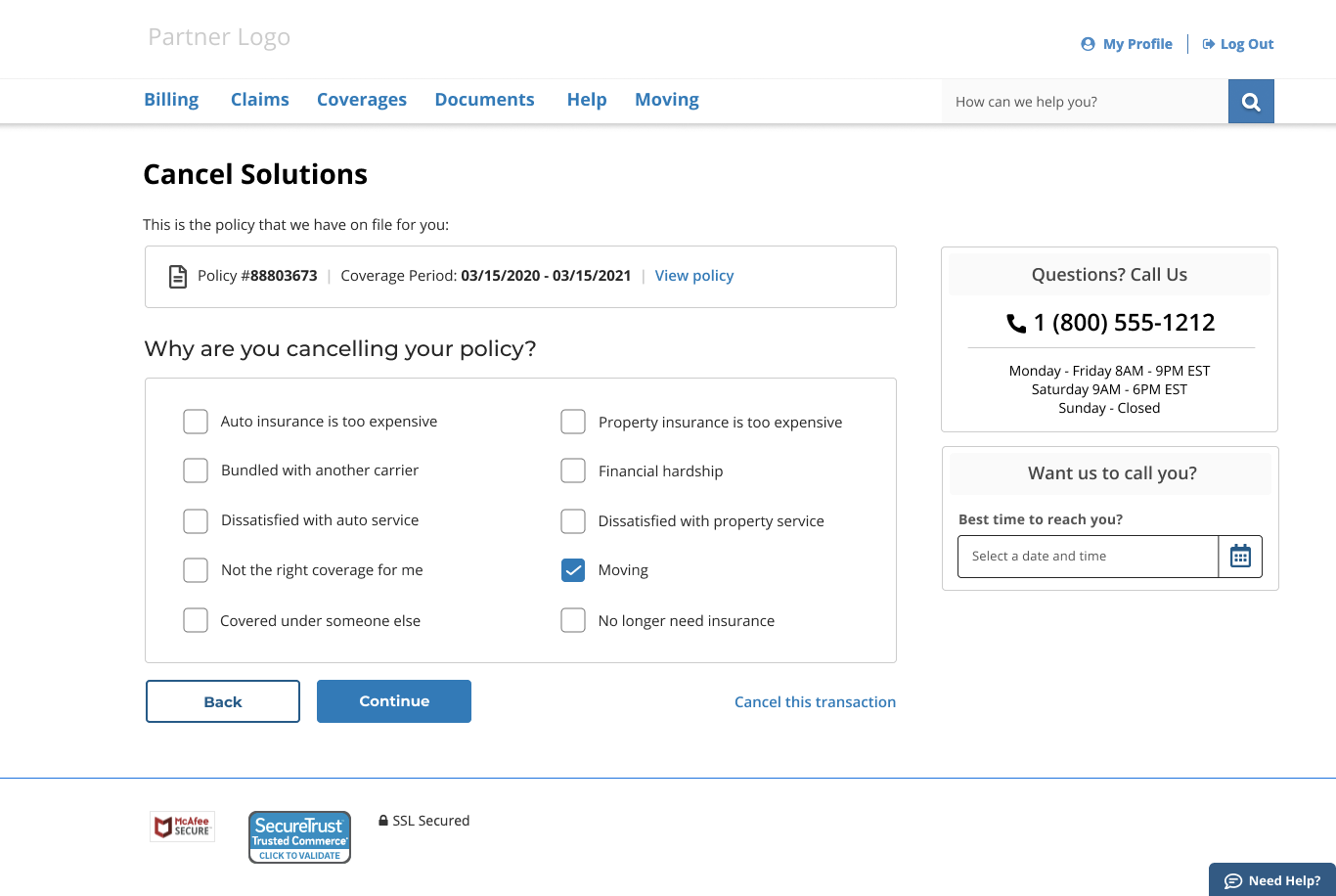

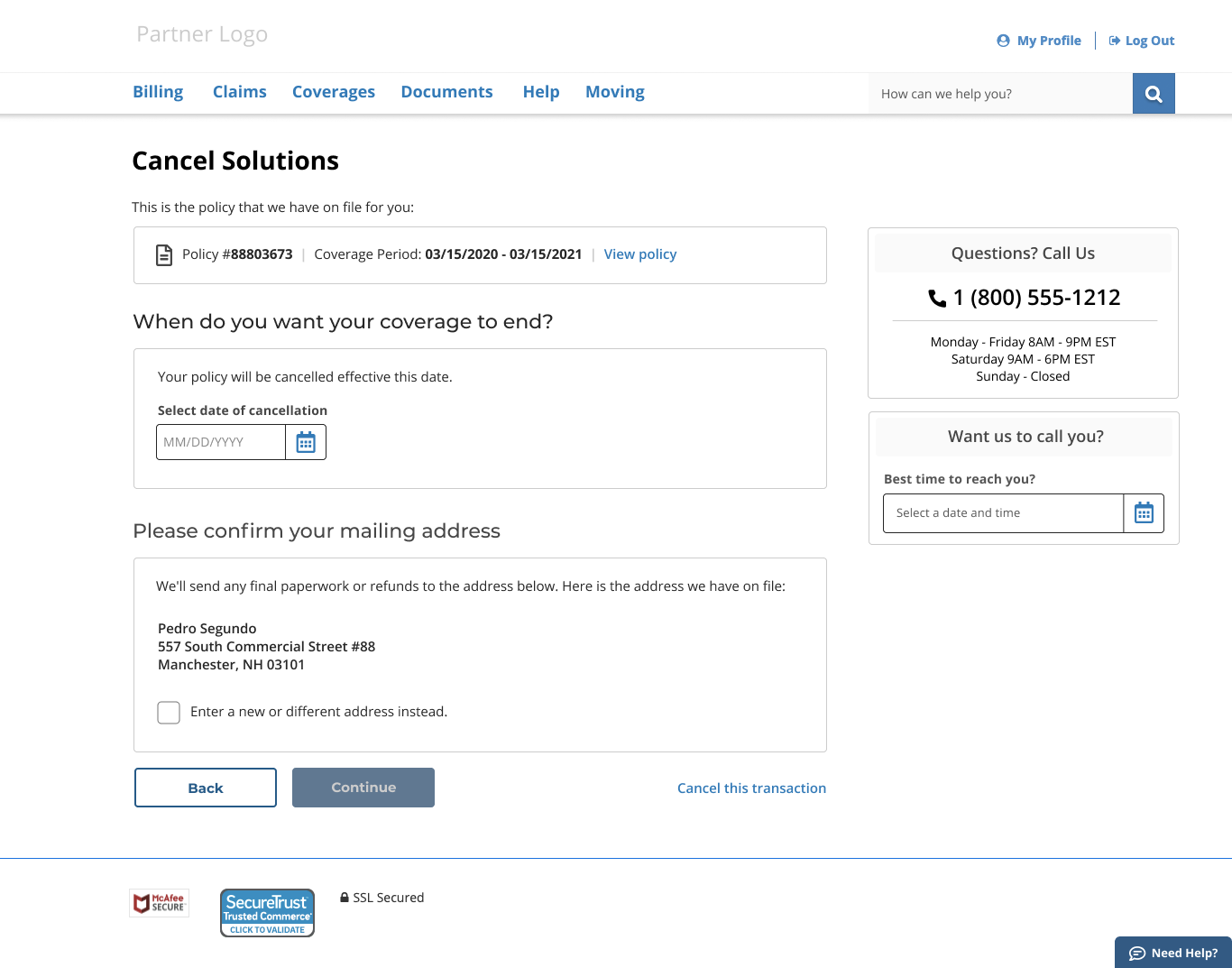

The main aim is to reduce customer cancellations through intervention, education, and solutions.

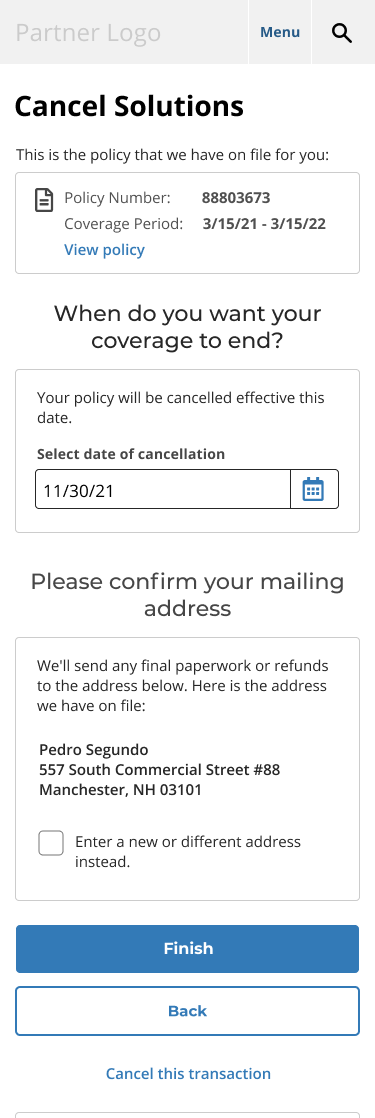

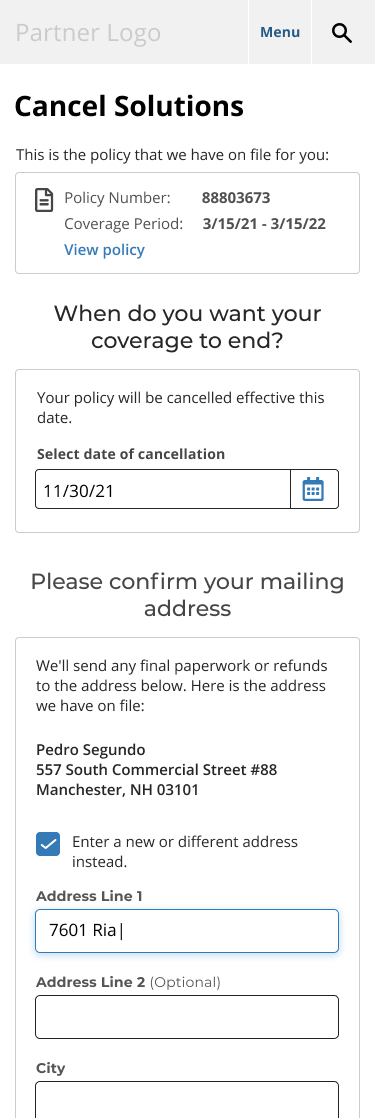

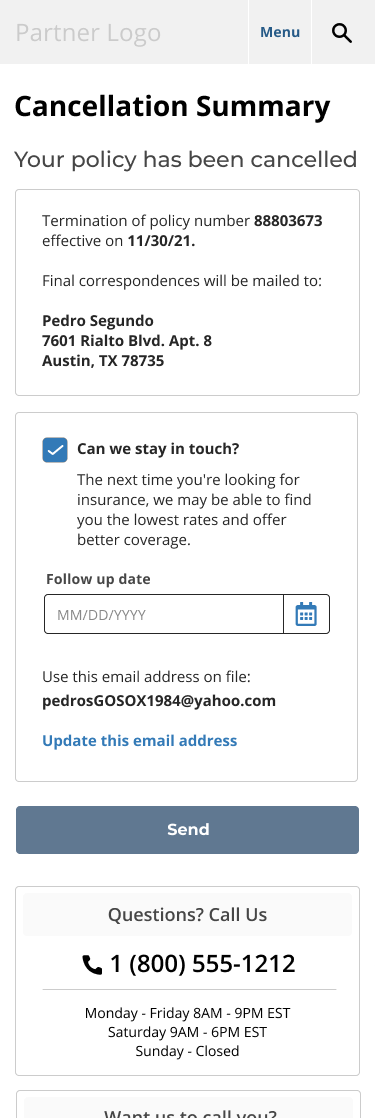

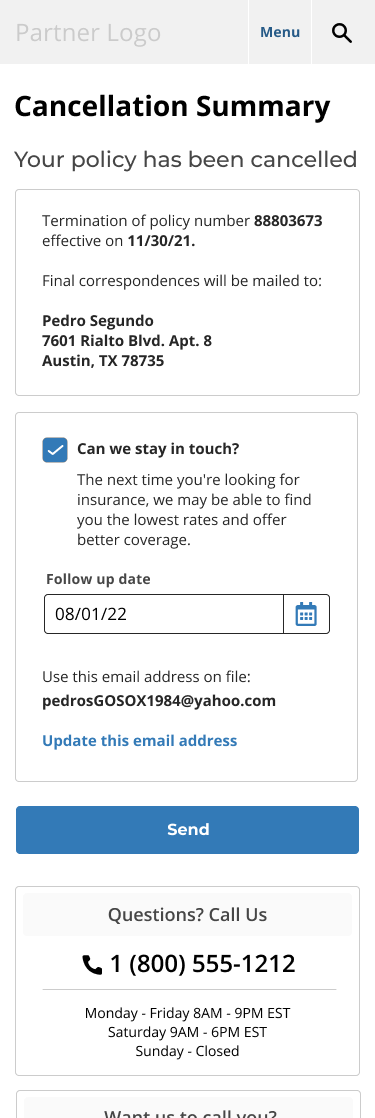

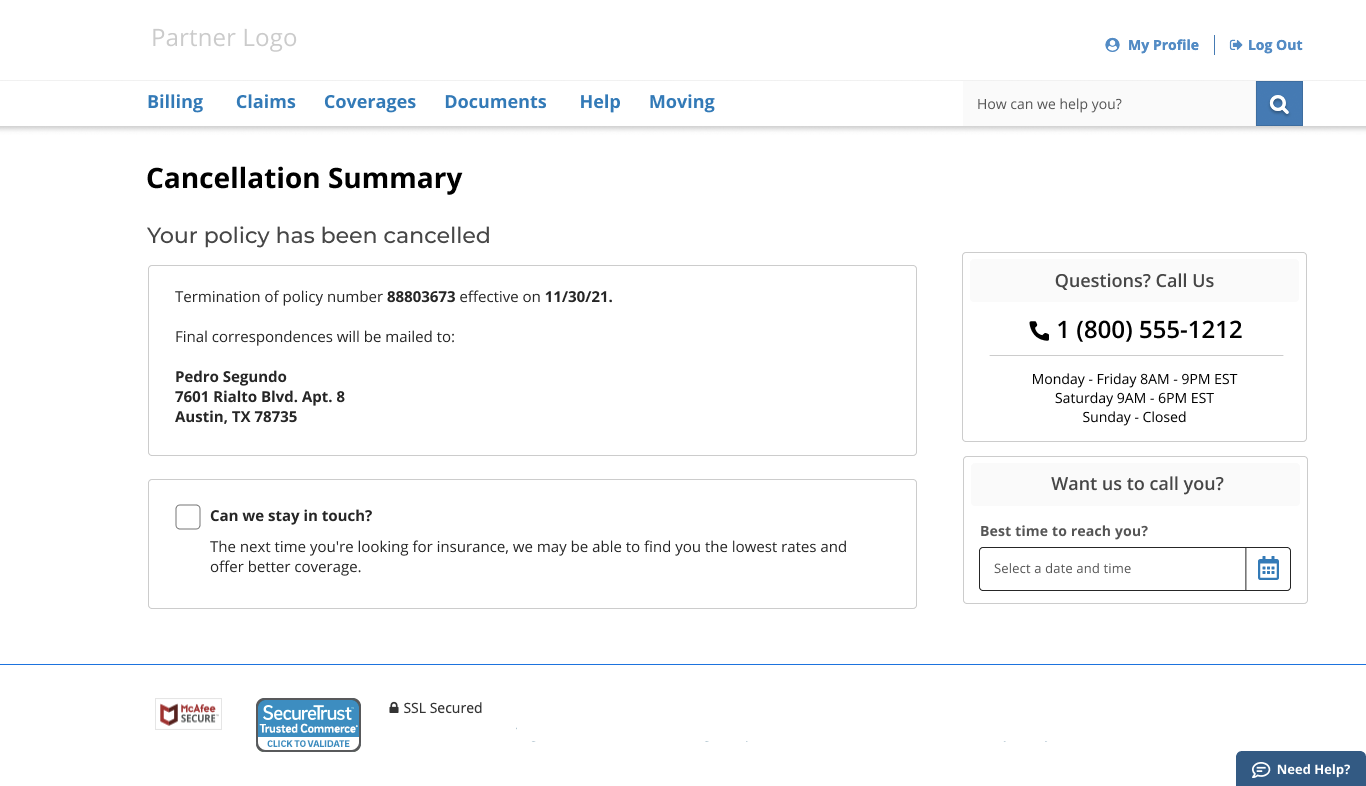

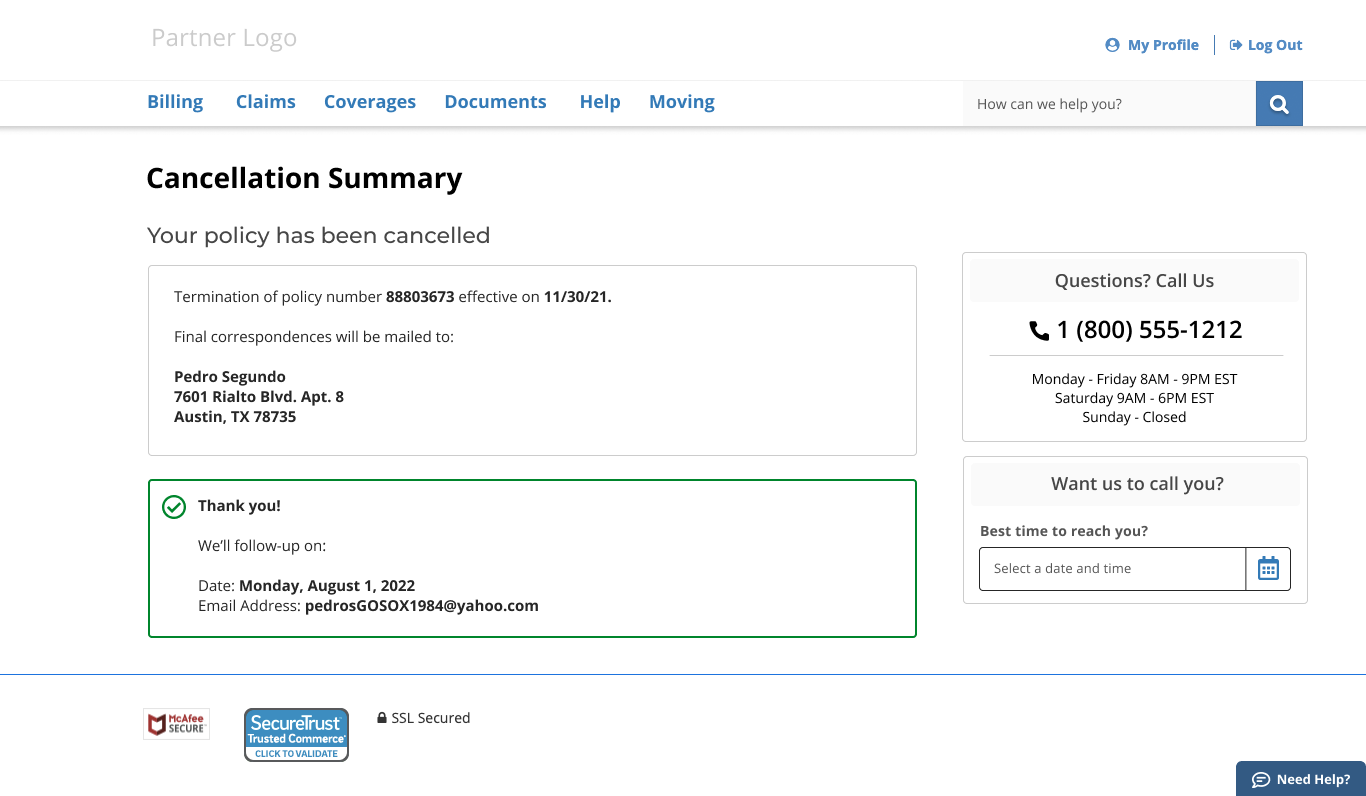

Allow customers to cancel and collect data without being intrusive.

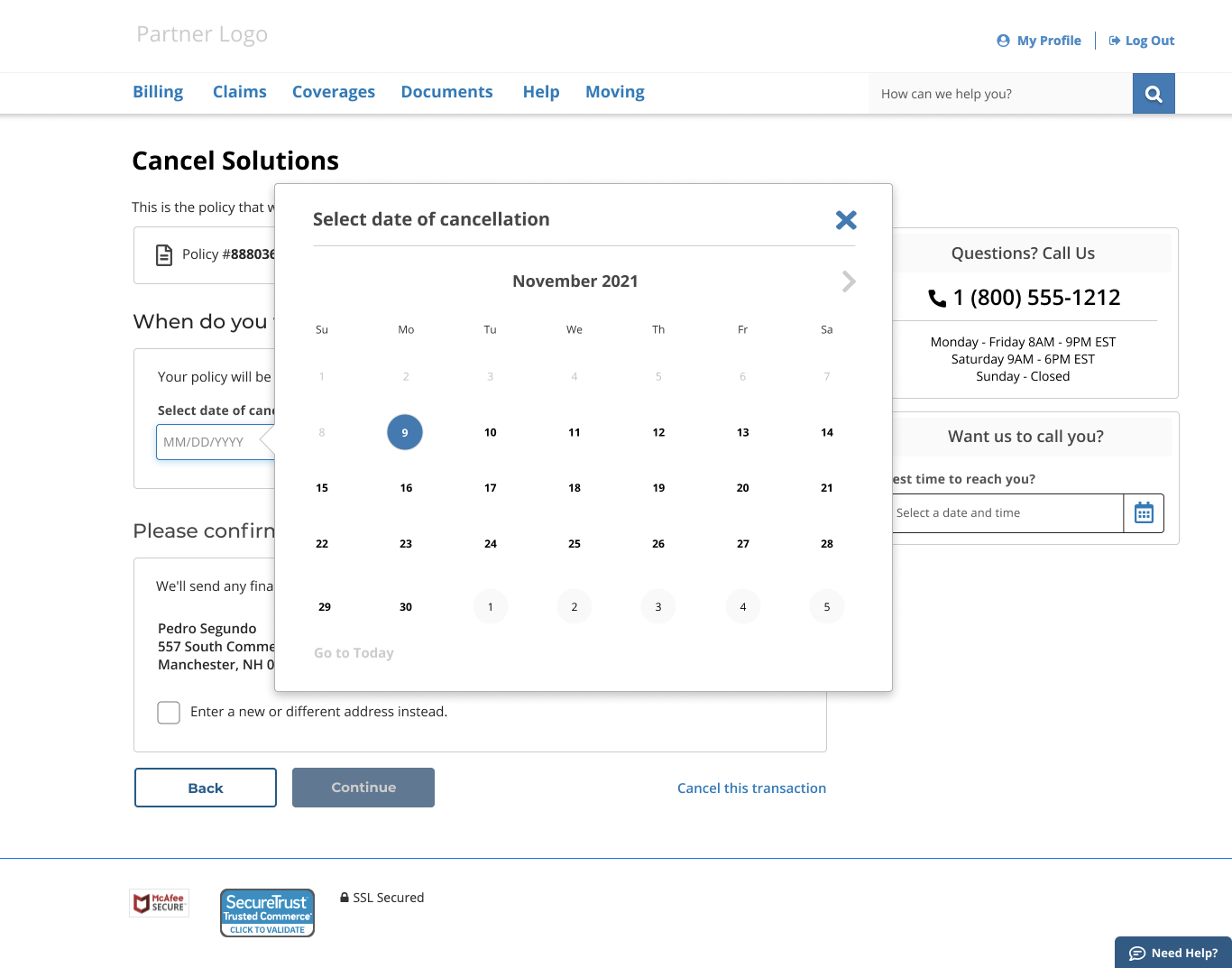

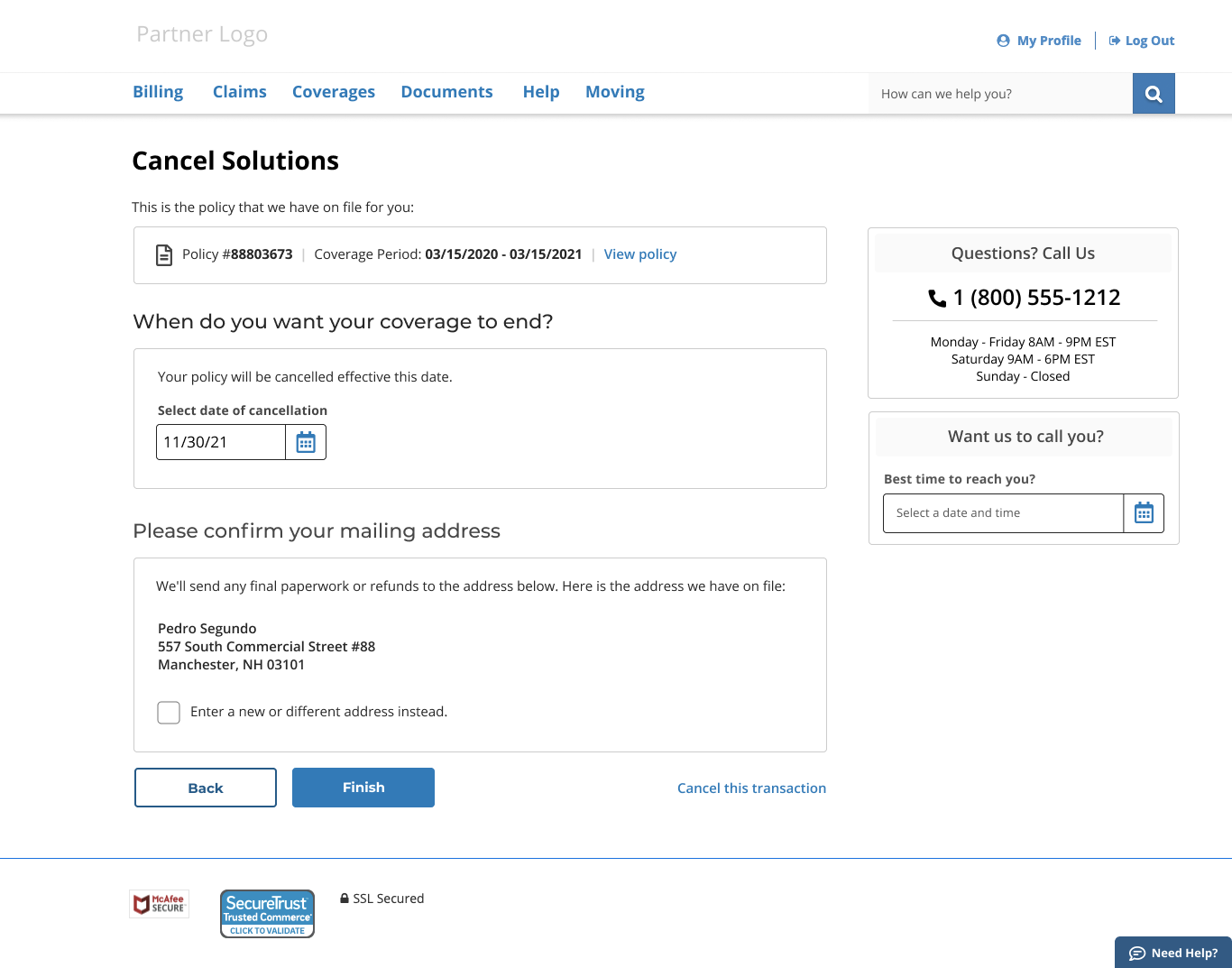

Develop experience flows dictated by cancellation reasons.

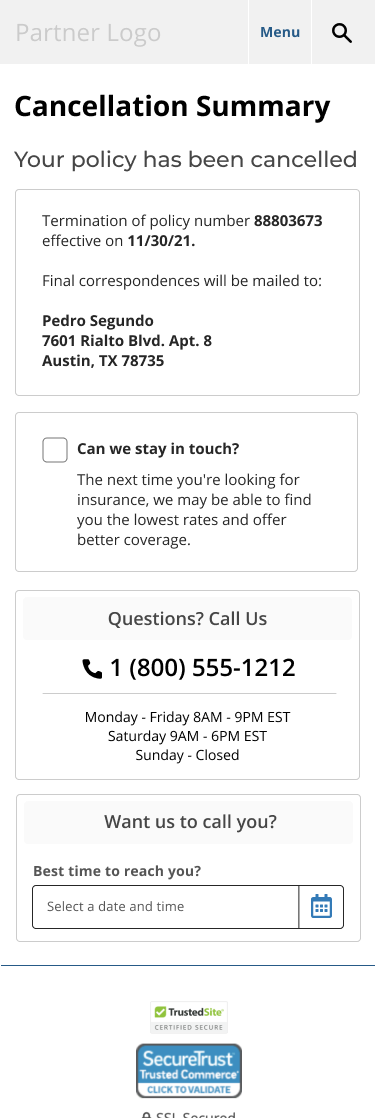

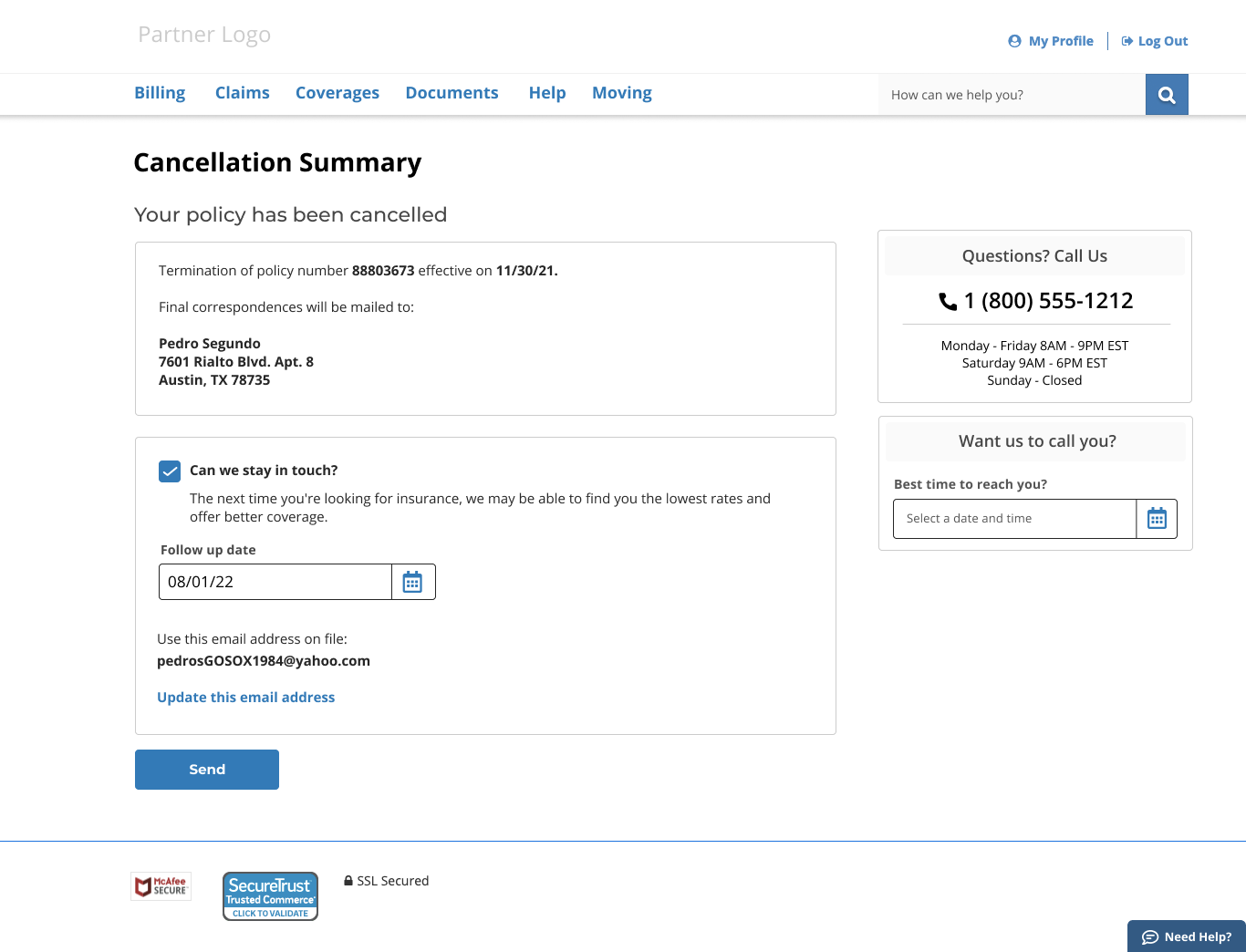

Create an opt-in to future chase for students and seasonal customers.

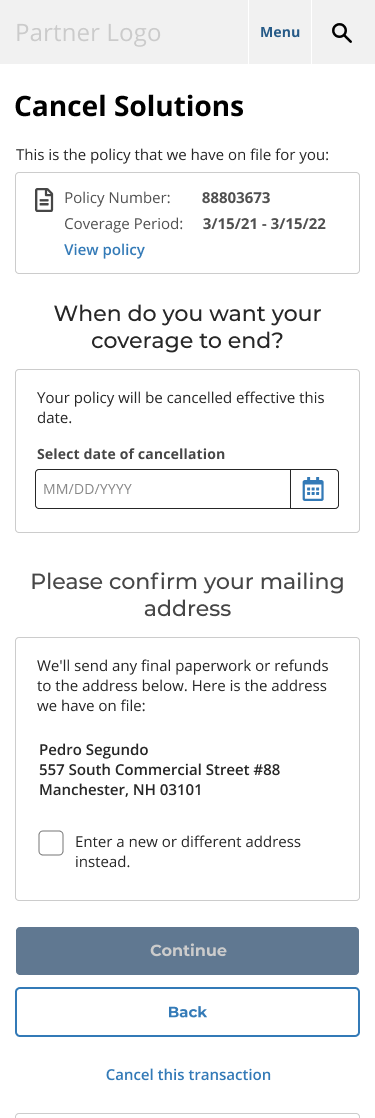

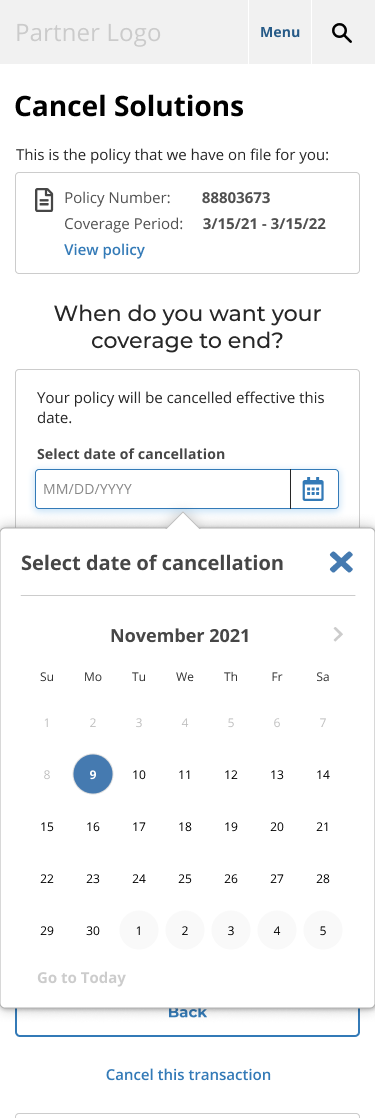

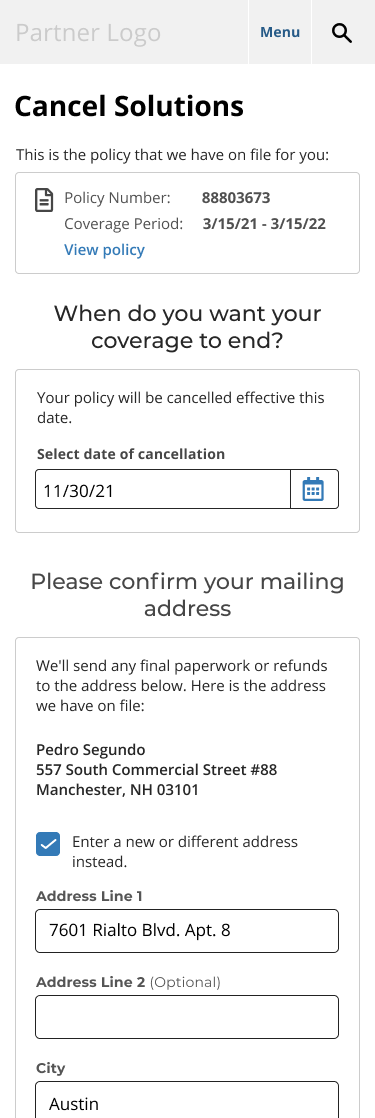

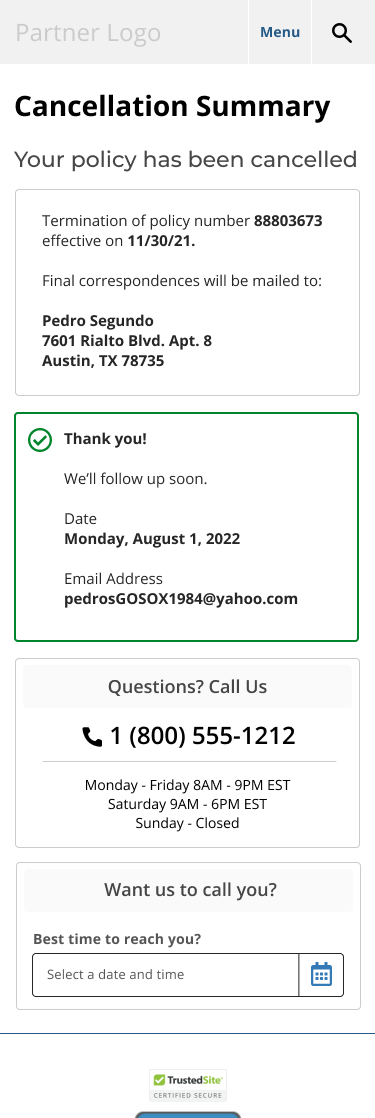

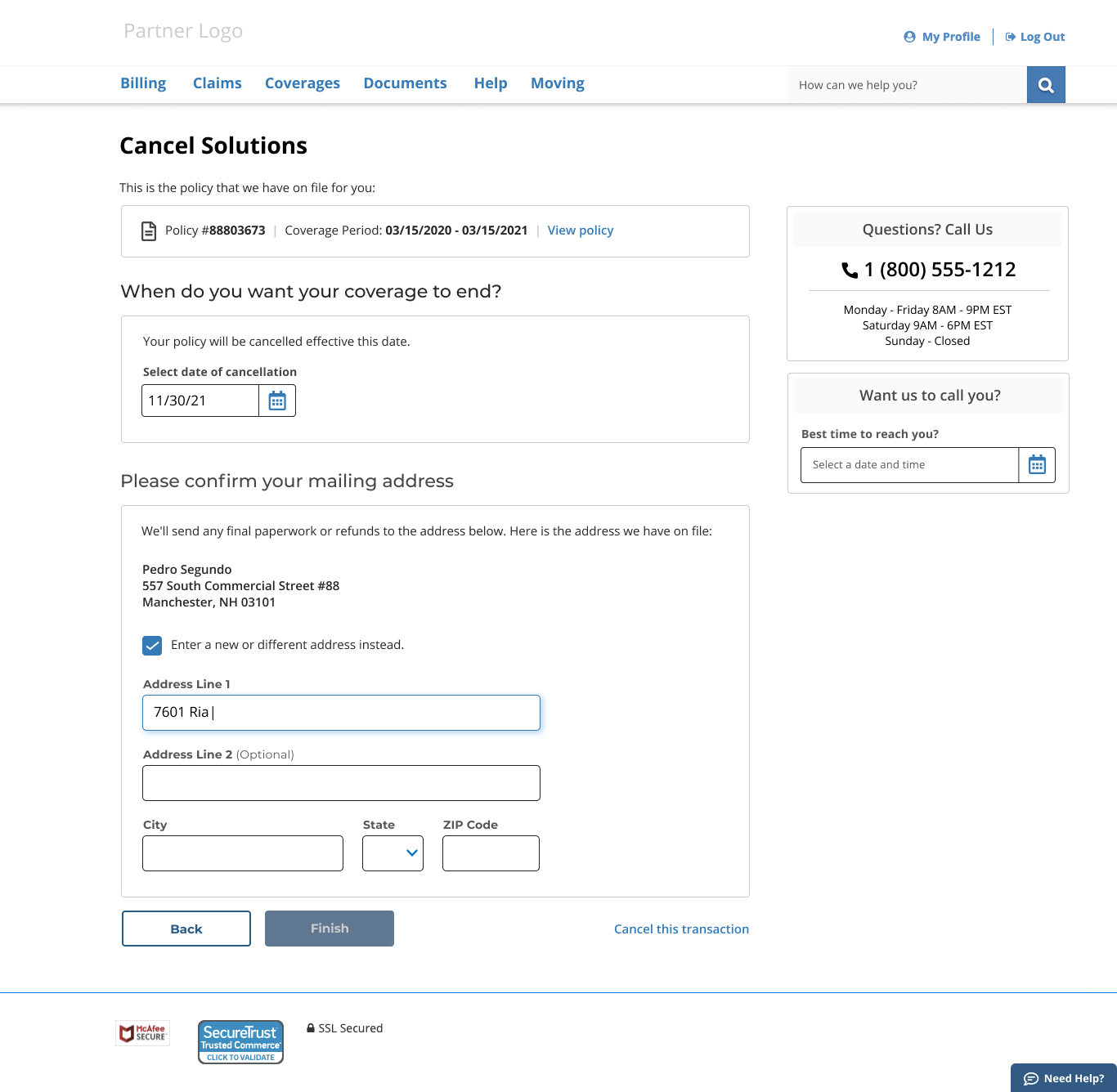

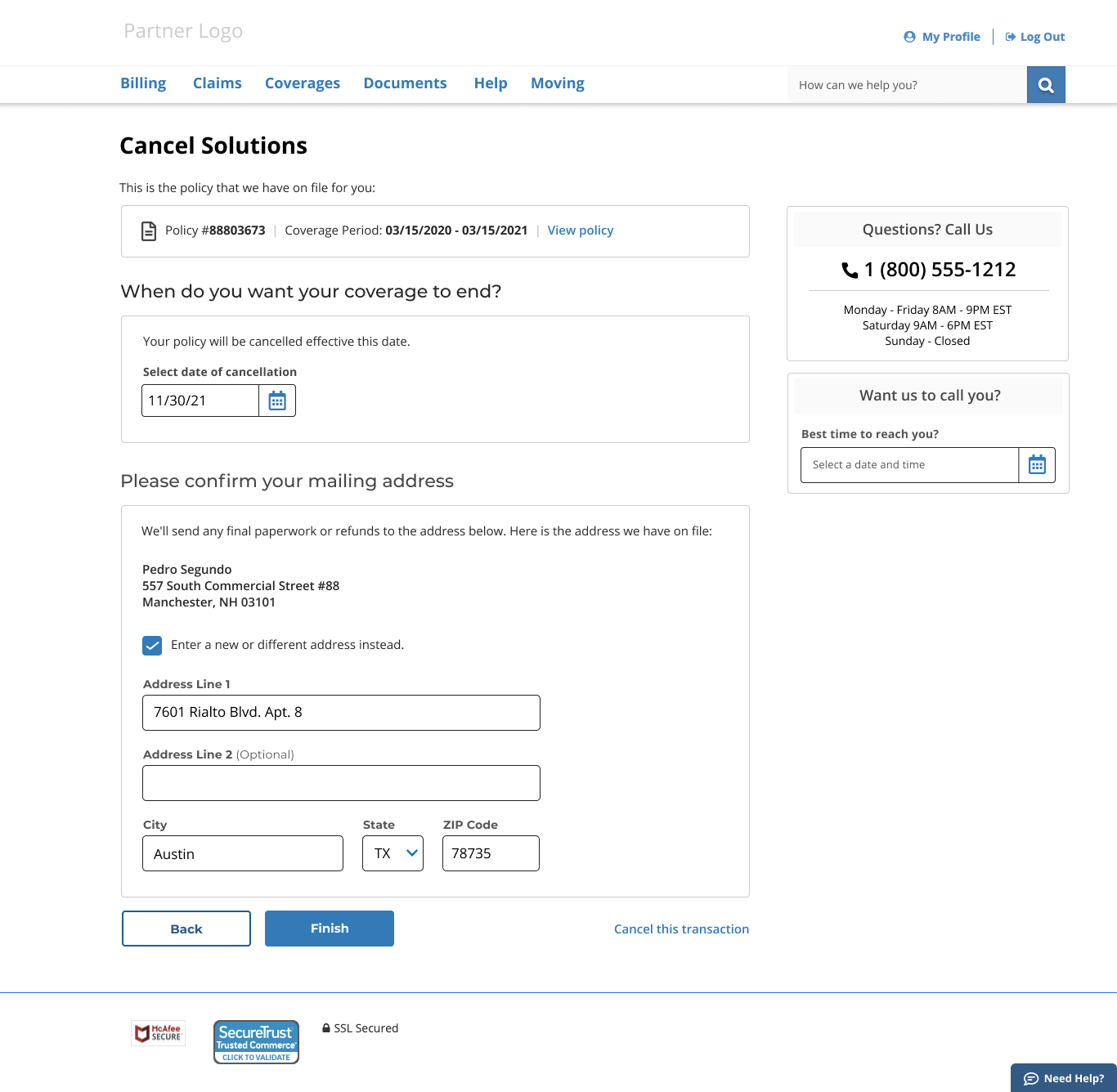

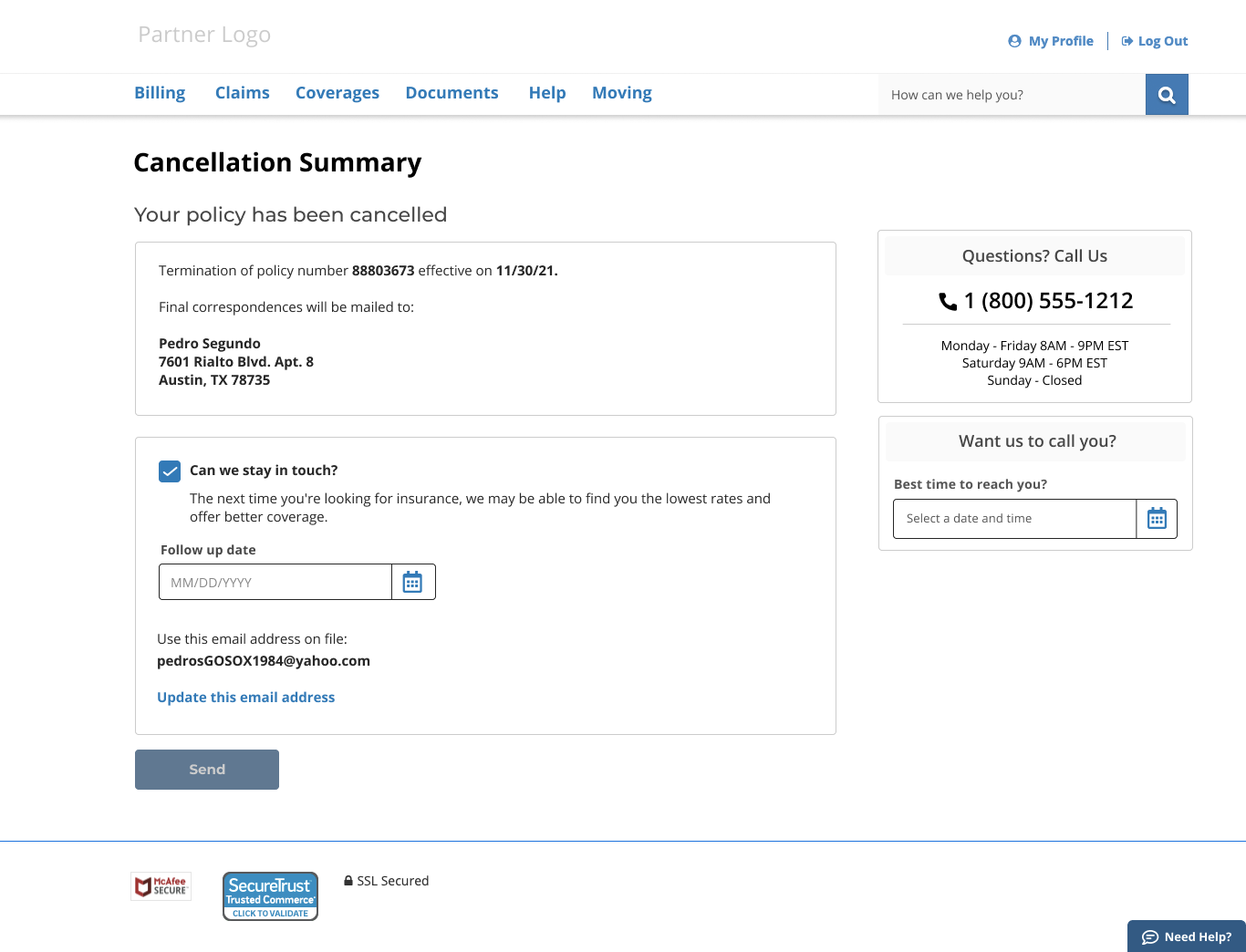

Transform a one-step cancellation flow to a three-step process: promote product value, identify coverage solutions, and offer additional engagement channels.

Create new entry points for cancellation.

Challenge—

Defining that there are two significant distinctions when it comes to canceling a policy. You are canceling a policy because you don’t need it anymore. Or you’re moving from one location to another and wish to keep the policy relationship with us.

Finally, how do we collect reasons for customers leaving without being intrusive?

Results—

Since the release, 6% of our customers have been retained, equaling 1.6M in premium.

360K calls are not going to cancellation; and instead, they are re-quoting for better offers.

10% of customers are opting into future chase emails, meaning they have agreed to allow us to email them at a later point.

Writing sample of this page available as a PDF file