HOMESITE INSURANCE

Case Study—

A Renter’s Moving Experience

At the peak of the pandemic in 2020, when lockdowns were widespread across the country, our call centers saw an increase of 48% for cancellation-related calls for the renters' line of business within our insurance policy platform.

As a part of the user experience team assigned to uncover why the call center was experiencing such volume, we commissioned a quantitative research study to inform possible strategic interventions to slow the cancellation volume.

The survey results showed that most customers were canceling not because they were dissatisfied with service or pricing but instead moving out of their urban dwellings to other places. Other findings included that some customers were unaware of their options to transfer or move their policy.

To add additional context, I conducted a handful of qualitative research sessions that further showed what customers wanted from their insurance experience.

The pandemic induced desires for improved 'livability,' taking the next step to homeownership for some. This change in market behavior was reflected in our primary service-related KPI.

To alleviate inbound call volume, I designed a digital experience that decreased cancellation calls by 6% and drove additional revenue by 1.6M in premium as we retained customers and offered them a new rental or homeowners insurance policy for their new place.

(Roles)

UX/UI Lead

(Methods & Tools)

Competitive Analysis

Customer Survey

Design Thinking

Affinity Diagrams

Mobile First

HotJar

Tableau

Figma

Illustrator

Miro Board

The Problem

First-time homebuyers moving might not know how to transfer their insurance policy. Perhaps they know how to move their policy but filling out lengthy forms is time-consuming and a mental drain.

In their minds, they are just moving. Do you transfer your policy, or do you cancel it first and re-quote it? If I change my address, will the policy follow me? Maybe I can do it after the move is made. This is all stressful because, at the same time, you don’t want to risk being not covered during a break-in or a nasty hurricane.

Before 2020 there was no other solution than to call a service agent. If time is money, for both parties, this is an expensive activity.

The Strategy

The key is to understand the current state of a policy holder's moving experience. Our research revealed potential insight into a future roadmap.

Improve quote referrals by making it easier to move insurance policies

Simplify the customer's process of obtaining new quotes, canceling previous policies, and maintaining multiple policies

Integrate disconnected processes of cancellations and billing as part of the moving experience

Provide discounts for renters moving into homeownership

Multi-Policy support

Make form entry easier by pre-filling customer's information

Provide customer grooming and education

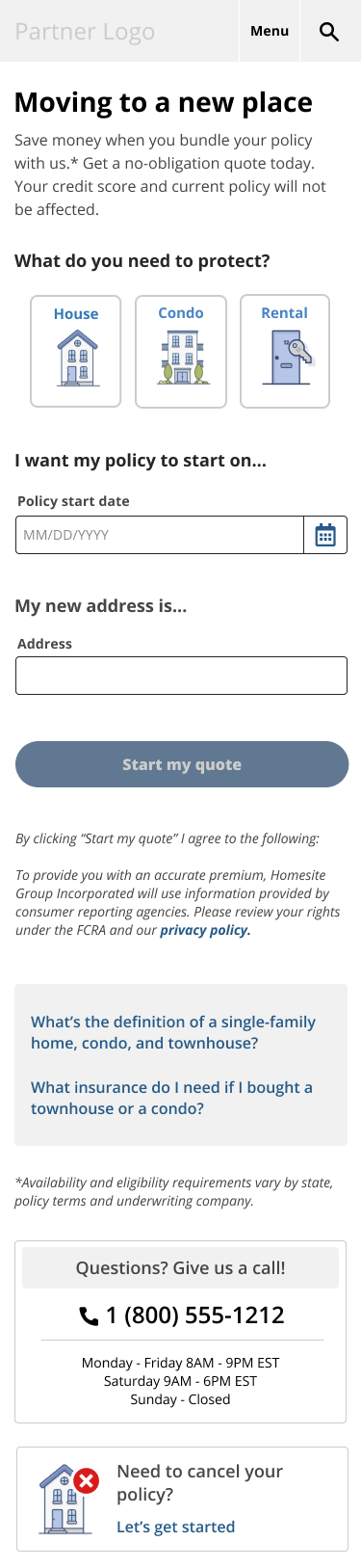

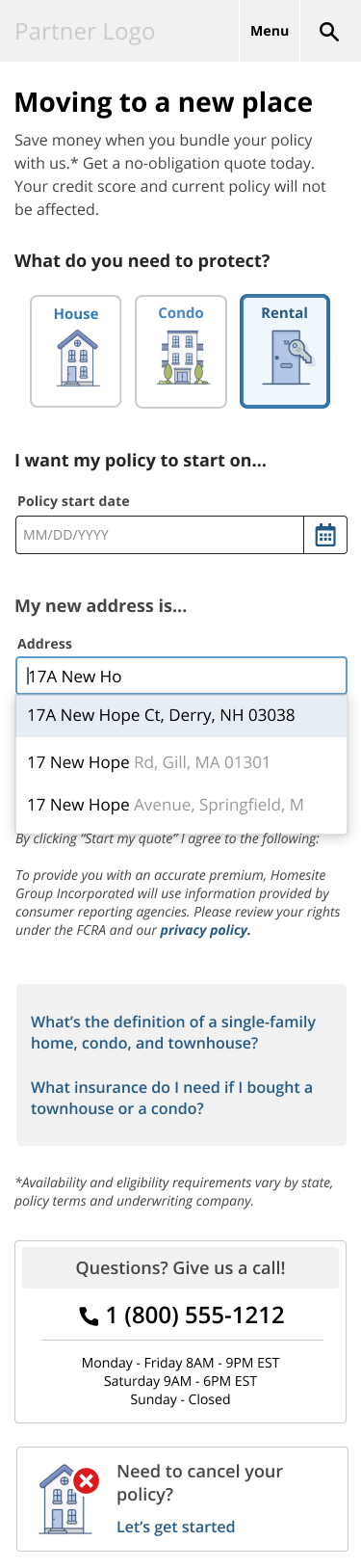

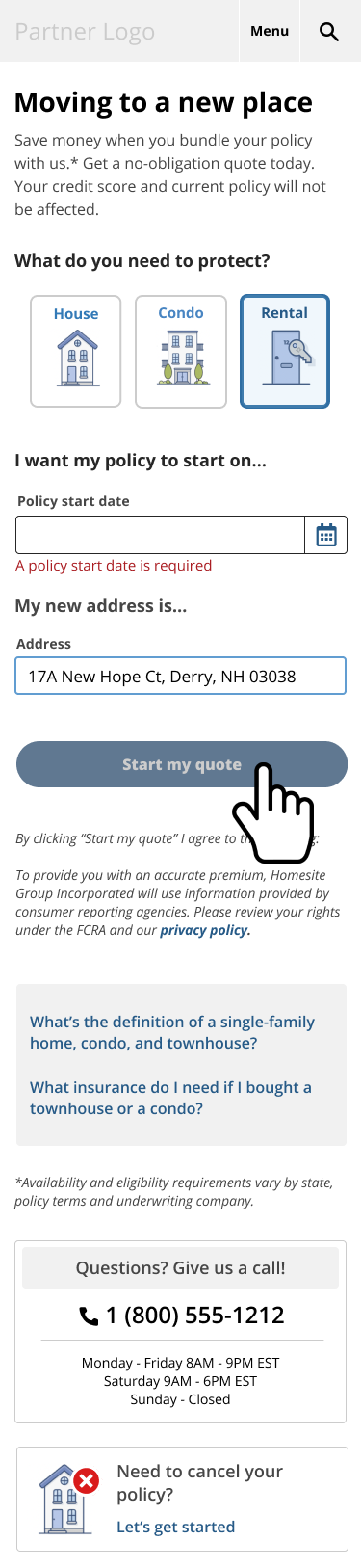

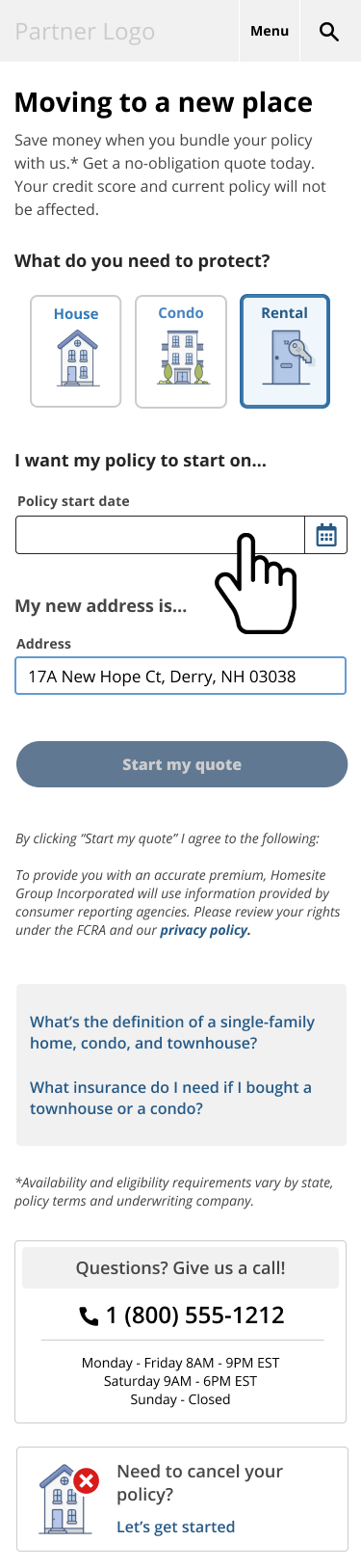

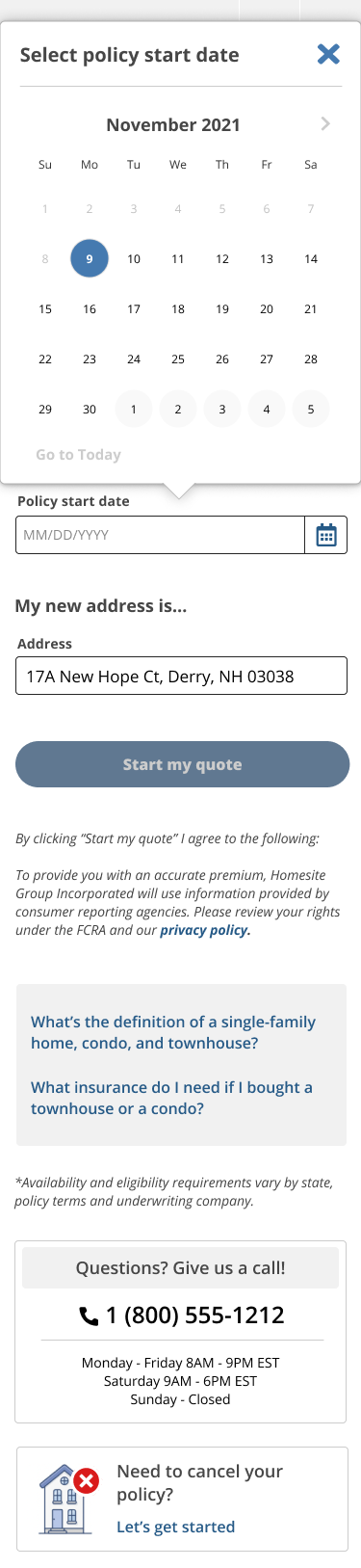

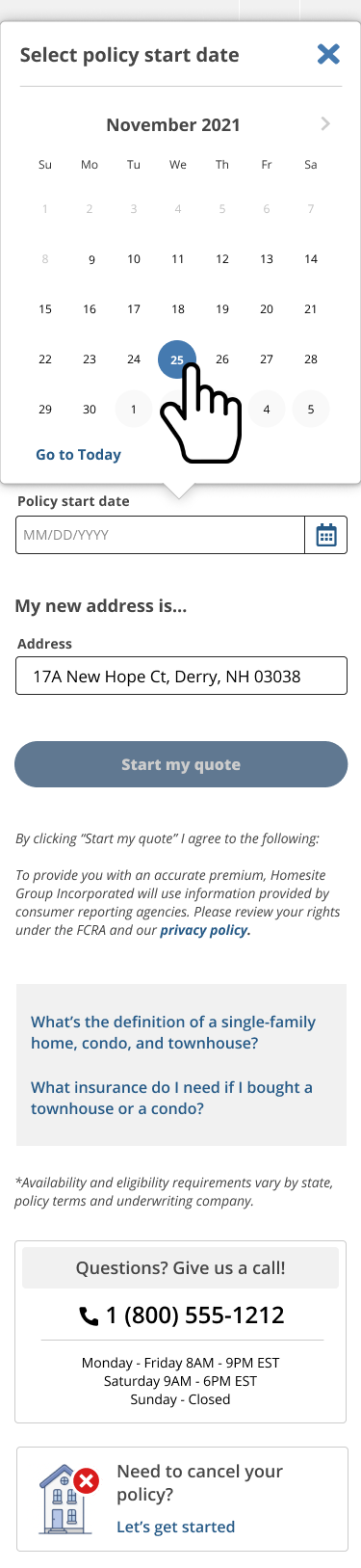

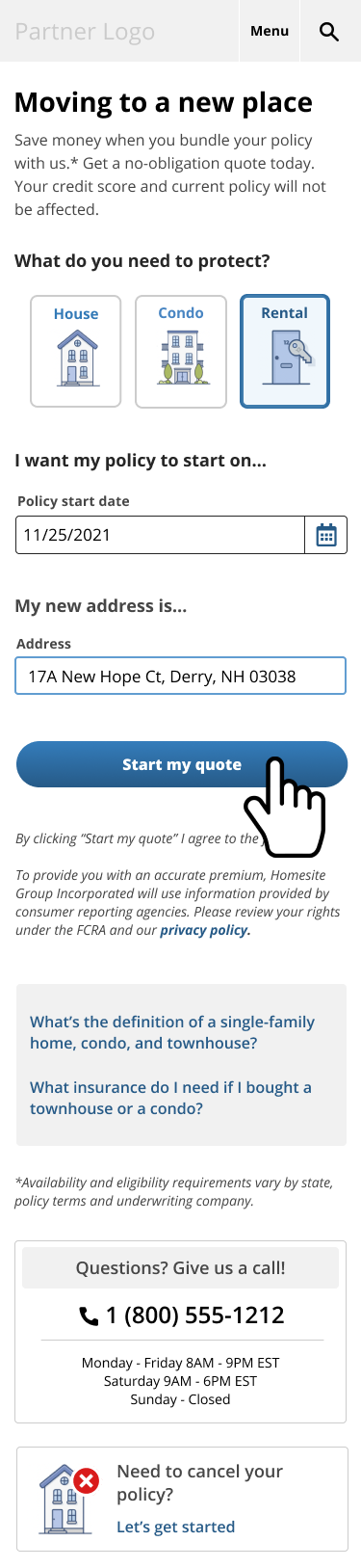

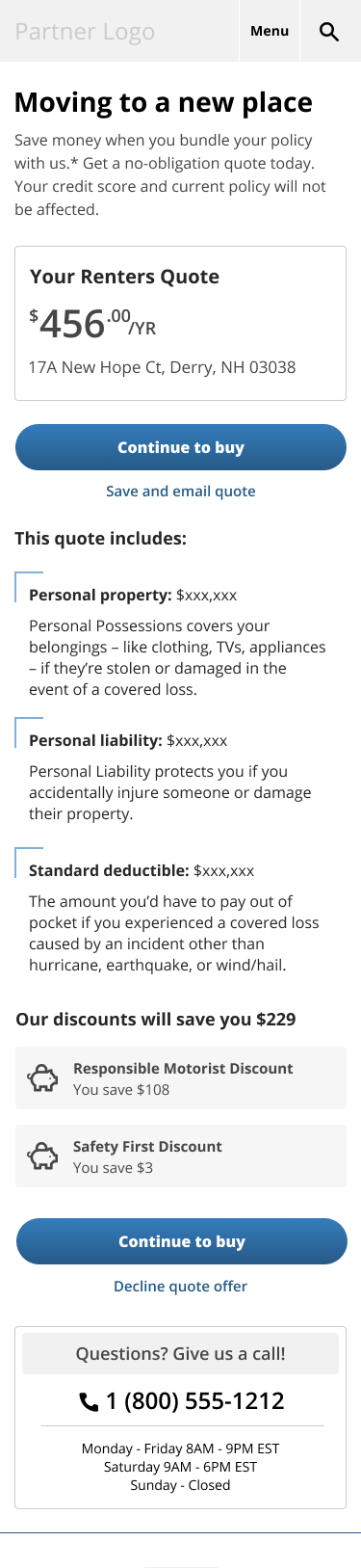

Mobile wireframes for a renter transferring their insurance policy to a new place: Selecting policy type, quote offer, and the call us experience.

Figma mobile designs for a current customer moving to a new place and wants to keep their policy (disclaimer: home graphics created by Dave Griepsma, people chatting sketch created by Chi-Yun Lau).

Results—

Improved renter to homeowner’s experience in the servicing side by retaining 7,560 customers and $4.3M in sold premium

Established a ‘graduators’ narrative supporting a renter’s moving experience into a new homeowner’s experience

Writing sample of this page available as a PDF file